LA DEFLATION EST A NOS PORTES

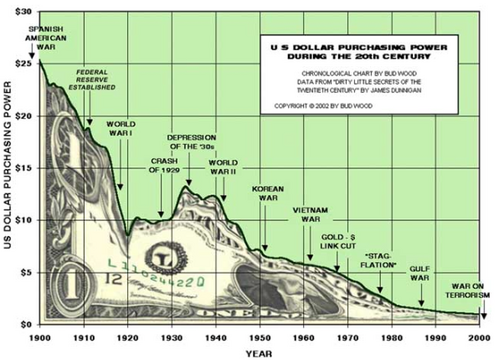

Je pense effectivement depuis longtemps que la déflation menace... LS, dans son nouvel essai tente de prouver le contraire... D'après lui, la création de monnaie doit pouvoir enrayer ce mécanisme sans problème... Les banques centrales ont donc la main... hum...

Je pense effectivement depuis longtemps que la déflation menace... LS, dans son nouvel essai tente de prouver le contraire... D'après lui, la création de monnaie doit pouvoir enrayer ce mécanisme sans problème... Les banques centrales ont donc la main... hum...

Pour ma part, je suis beaucoup plus sceptique... je pense même que les banques centrales ne sont pas loin d'avoir déjà tiré toutes leurs cartouches... seulement, la monnaie "en trop" est partie dans les actifs et non dans la consommation... et encore moins dans les salaires.... tout ceci ne peut plus que se dégonfler, un jour ou l'autre...

Encore un grand merci à LS qui nous fait encore une fois partager son travail...

Télécharger le document au format pdf

Bonne lecture...

La malédiction !